Bitcoin Mining Difficulty Adjustment - Miners Guide

A practical guide to Bitcoin mining difficulty adjustment—how retargets work, how to forecast them, and how to protect mining margins with smarter ops.

Bitcoin Mining Difficulty Adjustment: What Miners Need to Know

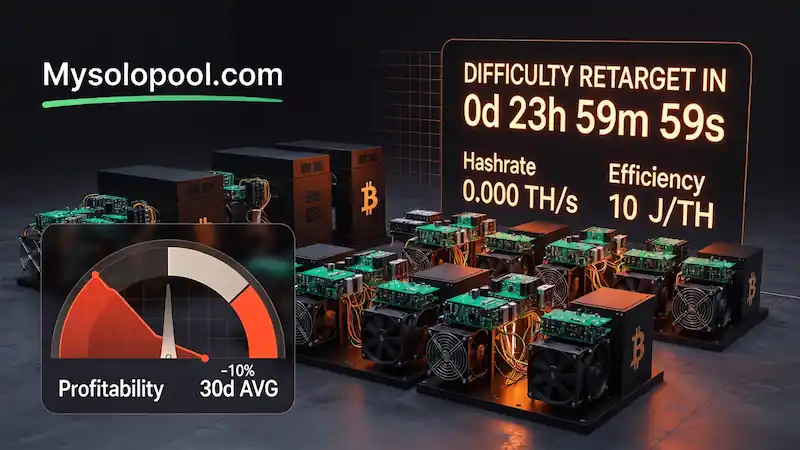

Bitcoin mining difficulty adjustment is the mechanism that keeps blocks close to one every 10 minutes—and it’s one of the biggest drivers of day-to-day mining profitability. If your margins are thin, a single retarget can be the difference between “print” and “power down.”

In this guide you’ll learn how difficulty retargets work (in plain language), how to estimate the size of the next adjustment, and what operational moves actually help: tuning J/TH, managing power costs, and choosing the right strategy—especially if you plan to mine SOLO on MySoloPool.com.

Why it matters: revenue per terahash is not stable. Difficulty changes re-price your hash output automatically, regardless of how good your uptime is. The miners who stay profitable are the ones who treat retarget day like a routine operations event, not a surprise.

Background: the fundamentals (without the math headache)

Bitcoin targets one block every 600 seconds (10 minutes). But the network’s total compute power (network hashrate) changes constantly as miners plug in, unplug, upgrade hardware, or chase cheaper power. If nothing corrected for that, blocks would come too fast when hashrate rises and too slow when it drops.

Difficulty is the self-correcting “knob.” Every 2016 blocks (about two weeks at 10 minutes per block), Bitcoin recalculates difficulty based on how long those 2016 blocks actually took to find. If blocks were found faster than 10 minutes on average, difficulty goes up; if slower, difficulty goes down.

The key mining takeaway: difficulty is a revenue divider. All else equal, if difficulty rises by 10%, your expected BTC earned per TH falls by roughly ~9.1% (because you’re now competing with more effective network work).

There’s also a safety cap: the adjustment per period is bounded to a 4× increase or a 0.25× decrease (a maximum 4x step in either direction), preventing extreme jumps in a single retarget.

How Bitcoin difficulty adjustment works (and how to estimate it)

The plain-English rule

Bitcoin looks at the last 2016 blocks and asks: “Did those blocks take more or less than 2016 × 10 minutes = 14 days?” Difficulty is then scaled by the ratio of expected time to actual time.

A real-world example you can copy

Suppose the last 2016 blocks were found in 12.0 days instead of 14.0. That means blocks were found ~16.7% faster than target. The next difficulty change would be approximately: 14.0 / 12.0 = 1.1667 → +16.7%.

If the opposite happened—say it took 15.5 days—then: 14.0 / 15.5 = 0.9032 → about -9.7%.

Operational shortcut: You don’t need full node math. Watch the average block time and the retarget countdown. If blocks average 9:30, difficulty is trending up; if 10:45, trending down.

Why difficulty moves in “steps”

Because adjustments only happen every 2016 blocks, profitability can drift for days. This is why miners often feel “squeezed” late in a period when hashrate has risen: blocks come in faster, the retarget estimate climbs, and your expected revenue per TH is effectively falling in real time—even before the official change lands.

What difficulty means for profitability (with numbers that matter)

The miner’s expected-value formula

Your expected BTC per day (before fees/variance) is roughly: (Your Hashrate / Network Hashrate) × 144 blocks/day × (Block Reward + Fees). After the 2024 halving, the base block subsidy is 3.125 BTC per block (fees vary by demand).

You’ll often see network hashrate estimated from difficulty; a common approximation is: Network Hashrate ≈ Difficulty × 2^32 / 600. For operations decisions, you can use any reputable dashboard or your pool stats—the key is to be consistent and watch trends.

Example: one modern ASIC, pre/post retarget

Let’s model a single 200 TH/s ASIC at 17.5 J/TH (about 3.5 kW at the wall), with network hashrate assumed at 600 EH/s. Expected BTC/day (subsidy only) is: (200 TH/s ÷ 600 EH/s) × 144 × 3.125 ≈ 0.000150 BTC/day.

| Scenario | Expected BTC/day | Power/day (3.5 kW) | Margin impact (rule of thumb) |

|---|---|---|---|

| Before retarget (baseline) | 0.000150 | 84 kWh/day | Baseline revenue per TH |

| Difficulty +10% (effective competition +10%) | ~0.000136 | 84 kWh/day | Revenue/TH down ~9.1% |

| Difficulty -10% | ~0.000167 | 84 kWh/day | Revenue/TH up ~11.1% |

Important: Power cost doesn’t care about difficulty. If your energy is expensive, difficulty increases hit twice: lower BTC output and the same kWh bill.

Fees: the “second paycheck” (but not predictable)

Transaction fees can range from a small add-on to a meaningful share of a block. In congested periods, it’s not unusual to see fees add 0.1–0.5 BTC to a block, and historically there have been spikes above that. Treat fees as upside and a volatility source—not something you should budget as guaranteed.

Forecast the next retarget: a simple operator workflow

Step-by-step: build a retarget “pre-check”

- Check remaining blocks: note how many blocks are left in the 2016-block window.

- Check average block time: use a dashboard showing the current period’s average (e.g., 9:45 or 10:20).

- Estimate the change: approximate ratio = 10:00 / (avg block time). Example: avg 9:30 → 10/9.5 ≈ 1.0526 → ~+5.3%.

- Translate to revenue: expected revenue/TH scales roughly by 1/(difficulty change). +8% difficulty → ~-7.4% revenue/TH.

- Take action: decide whether to keep the same clocking, underclock for efficiency, or curtail high-cost hours.

Caution: If your margin is thin, don’t wait for the official retarget block. The economic squeeze often happens during the period as hashrate rises and blocks accelerate.

What to monitor weekly

- J/TH at the wall: efficiency is your first-line defense against rising difficulty.

- Uptime and reject rate: a 1–2% reject rate can erase the benefit of a good tune.

- Effective $/kWh: include demand charges, hosting fees, and seasonal rates—not just the advertised tariff.

- Cooling headroom: higher intake temps quietly reduce stability and efficiency, especially on aggressive profiles.

Internal linking opportunity: Hashrate.farm’s profitability tooling and operational checklists can help you standardize these metrics across multiple rigs and sites so retarget day becomes routine.

Operational playbook: what to do before and after a difficulty change

Before the retarget (48–72 hours)

- Lock stable settings: avoid new overclocks right before a retarget; instability plus higher difficulty is a double hit.

- Run an efficiency test: compare profiles like Balanced vs Eco for 6–12 hours each and record TH/s, watts, and rejects.

- Set a curtail threshold: define a max $/kWh (or min $/day margin) where rigs downshift or pause during expensive hours.

After the retarget (first 24 hours)

- Recalculate break-even: if revenue/TH fell, your acceptable power price fell too. Update thresholds immediately.

- Watch rejects and temps: if you underclock for efficiency, you may reduce heat and improve stability—a hidden gain.

- Validate pool/solo telemetry: confirm shares accepted, latency, and stale shares are normal.

The disciplined approach is simple: optimize for J/TH first, then chase extra TH/s only if you have cheap, stable power and cooling headroom.

Solo mining and difficulty: setting expectations (mysolopool.com)

Difficulty affects solo miners the same way it affects everyone: higher difficulty means your hashrate represents a smaller slice of the network, so your expected time to find a block increases. The difference is that solo mining has extreme variance: you might find a block tomorrow—or not for months—depending on your hashrate.

If your goal is maximum sovereignty and you can handle payout variance, mine solo on mysolopool.com. You keep the full block reward (subsidy + fees) when you hit, and you can run a clean, measurable operation around your own odds.

A practical way to think about solo odds

Bitcoin finds ~144 blocks/day. If your share of network hashrate is \(s\), your expected blocks/day is \(144 × s\). Using the earlier example (200 TH/s vs 600 EH/s), \(s ≈ 3.33×10^{-7}\), so expected blocks/day is ~0.000048—about one block every ~20,800 days on average. That doesn’t mean “impossible”; it means variance is the whole game.

Pro insight: Solo mining is an operations discipline. Your edge comes from uptime, low rejects, low $/kWh, and efficient J/TH—so your “ticket cost” stays low while you wait.

Pro tips (experienced miners do these)

- Track revenue per TH, not just BTC/day: it normalizes for fleet changes and shows difficulty pressure immediately.

- Keep an “Eco fallback” profile ready: one click (or script) to drop watts when difficulty jumps or power prices spike.

- Measure at the wall: PSU efficiency and facility losses matter; base decisions on real kW, not firmware estimates.

- Set a reject-rate alert: treat sustained rejects above ~0.5–1.0% as a profitability incident.

- Plan cooling like it’s part of hashrate: a stable intake temperature often beats an aggressive overclock in net BTC.

- Use difficulty forecasts for scheduling maintenance: do downtime when the next retarget is likely to increase (when your opportunity cost is highest).

- Standardize your checklist: documenting settings, temps, watts, and stability per rig is how small miners operate like pros—Hashrate.farm can help systematize this.

Common mistakes to avoid

- Chasing TH/s while ignoring J/TH: at typical power prices, efficiency usually wins after a difficulty increase.

- Assuming fees will save you: fee spikes happen, but they’re not a business plan; budget for subsidy-only periods.

- Making big tune changes right before retarget: instability (stales/rejects/reboots) can cost more than the difficulty move itself.

- Using the wrong power number: ignoring demand charges, PSU losses, or hosting add-ons leads to “profitable on paper” rigs that lose money in reality.

- Not sizing variance for solo mining: solo on mysolopool.com is viable for some miners, but you must plan emotionally and financially for long droughts.

FAQs (schema-friendly)

How often does Bitcoin mining difficulty adjust?

Every 2016 blocks, which is designed to be about 14 days (two weeks) at the 10-minute block target.

Can difficulty go down?

Yes. If blocks are found slower than 10 minutes on average over a 2016-block window, difficulty decreases to bring block times back toward target.

Does a difficulty increase always mean I should shut off miners?

Not always. It means your expected BTC per TH falls; the right response depends on your $ / kWh, your rig’s J/TH, and whether you can underclock to improve efficiency while staying stable.

How does difficulty affect solo mining on mysolopool.com?

Higher difficulty reduces your probability of finding a block per unit time (because your share of the network is smaller), increasing expected time between wins. Your operational focus becomes minimizing “ticket cost” (watts, rejects, downtime) while you wait.

Conclusion

Bitcoin mining difficulty adjustment is predictable in timing and brutal in impact: it continuously re-prices your hashrate against the network. The miners who win treat retargets as an operations cycle—forecast the change, optimize J/TH, and keep rejects and power costs under control.

If you want to run tighter numbers and cleaner operations, Hashrate.farm can help with profitability analysis, efficiency planning, and standardized fleet checklists—so difficulty changes become routine, not chaos.