Bitcoin Network Hashrate Hits a New All-Time High Update

Bitcoin network hashrate set a new ATH near 1.44 ZH/s, pushing difficulty higher. Here’s what miners should adjust to protect efficiency and margins.

Bitcoin Network Hashrate Hits a New All-Time High Update

Bitcoin network hashrate set a new ATH near 1.44 ZH/s, pushing difficulty higher. Here’s what miners should adjust to protect efficiency and margins.

Headline: Bitcoin network hashrate reaches a new all-time high

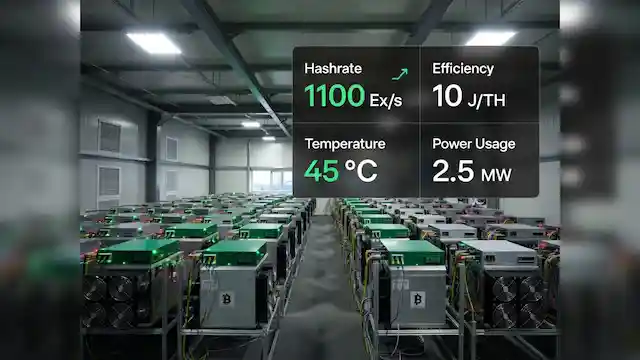

Bitcoin network hashrate just printed a new all-time high (ATH), with major trackers showing a peak around ~1,441 EH/s (~1.44 ZH/s).

For miners, that headline translates into one practical outcome: your share of the block reward gets smaller unless your efficiency (W/TH) and uptime improve.

Key details for miners: profitability under higher hashrate

Hashrate ATHs usually arrive alongside tougher competition. Even if your rigs are unchanged, higher network hashrate typically drives higher difficulty over subsequent adjustments, reducing BTC earned per terahash.

| Network metric | Recent value (approx.) | What it means for miners |

|---|---|---|

| Hashrate peak | ~1,441 EH/s (~1.44 ZH/s) | Your share of total hash shrinks unless you add hashrate or improve efficiency. |

| Mining difficulty | ~146T | Higher difficulty generally means lower BTC/TH at the same uptime and fees. |

| Block subsidy | 3.125 BTC | Subsidy is fixed; competition determines how much of it you capture. |

What action is required right now?

- Re-check your break-even power price: If network hashrate rises 10%, your expected BTC share per TH falls by roughly ~9% (all else equal). Update your model before you add machines.

- Prioritize efficiency over raw TH: A small W/TH improvement often beats adding hash at high $/kWh.

- Watch fees and pool performance: Payout variance matters more when margins tighten; track stale shares, latency, and pool fees.

Pro Tip: Use the Hashrate.farm Profitability Calculator to stress-test revenue under +5% to +15% difficulty scenarios, then compare against your real power bill.

Warning: Don’t assume “record hashrate” equals “record profit.” If your fleet’s efficiency is behind the network average, difficulty increases can turn borderline units negative fast.

Quick context: why the Bitcoin network hashrate ATH matters

Hashrate is the network’s total mining power. When it reaches an ATH, it’s a sign that more (or more efficient) hardware is online competing for the same block subsidy (plus transaction fees). That competition typically pushes difficulty up over time, reducing payouts per TH.

In plain terms: the most reliable way to stay profitable is to run efficiently, minimize downtime, and plan capacity using realistic difficulty assumptions.

Next steps and links

- Model your margins: Try the Hashrate.farm Profitability Calculator with your exact W/TH and $/kWh.

- Improve uptime: Consider Hashrate.farm Hosting options designed for stable power and cooling.

FAQ: Bitcoin network hashrate and miner profitability

Does a higher hashrate mean BTC price will rise?

No. Hashrate measures mining competition and security, not price direction.

Should I shut off older ASICs?

Only if your all-in power + hosting cost exceeds expected revenue. Re-check break-even after each difficulty move.

What’s the fastest efficiency win?

Firmware tuning/undervolting, better airflow, and reducing downtime usually deliver the quickest ROI.